The End of Generic ICPs in 2026: Building Data-Driven Personas From Real-Time Intent (With Technographics at the Core)

For years, "ICP" meant a one-pager in a deck: industry, company size, maybe revenue band, and a vague job title or two.

It looked neat. It almost never matched reality.

Today, buyers move faster, stacks change monthly, and intent is visible long before a form fill. A static ICP built on firmographics alone is basically a poster on the wall. The teams that are winning are building living, data-driven personas that update as their market moves—with technographics and real-time intent doing most of the heavy lifting.

Why Generic ICPs Don't Cut It Anymore

A generic ICP might say: "Mid-market SaaS, 200–1,000 employees, North America, Head of Operations." Sounds focused, but it misses three critical questions:

- What does their tech stack look like right now?

- What problems is that stack creating or failing to solve?

- What are they actively researching or evaluating this quarter?

Firmographics tell you who they are. Technographics and intent tell you what they're running on and what they're trying to change, right now.

When you don't include those layers:

- You target companies that will never buy because their stack makes them a bad fit.

- You pitch features they already have covered.

- You completely miss accounts that are actively in a switching cycle.

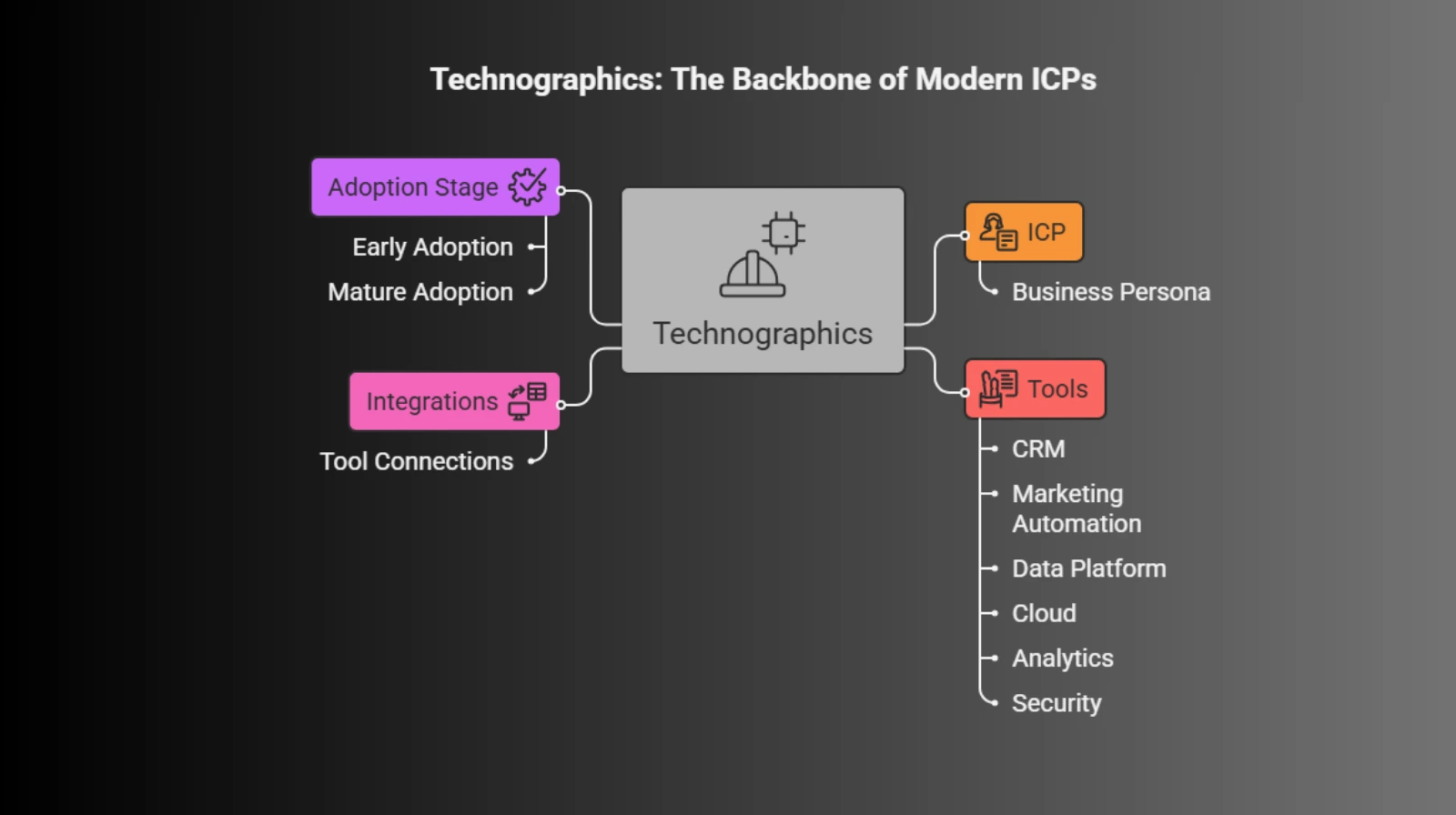

Technographics: The Missing Backbone of Your ICP

Technographics : detailed insight into a company's technology stack—what tools they use, how mature their setup is, and where the gaps are.

This includes data like:

- CRM, MAP, CDP, and data tools in use

- Cloud, security, analytics, and collaboration platforms

- Adoption dates, usage patterns, and integration footprints

Why this matters for ICP and personas:

- You can spot buyers running a competitor and time "rip-and-replace" campaigns around renewal or expansion.

- You can prioritize accounts whose stack plays nicely with your product (integration-led selling).

- You can tailor your narrative to their exact environment: legacy migration, consolidation, cost-cutting, or modernization.

In other words: technographics turn "Head of Ops at a mid-market SaaS" into "Head of Ops at a mid-market SaaS, running Tool X + Tool Y, hitting specific integration and reporting walls that our product solves."

Layering in Real-Time Intent Signals

Technographics tell you what they have. Intent tells you what they're trying to figure out right now.

Real-time intent signals include:

- Spikes in research around your category or competitor names on third-party sites

- Visits to comparison pages, pricing, docs, and integration pages

- Webinar attendance, content downloads, trial signups, and high-intent page visits

On their own, these signals are useful. Combined with technographics, they're gold:

- A company running your main competitor, whose intent data shows them researching "alternatives" and "migration best practices"

- An account that just adopted a tool you integrate with, now reading content on "how to get more value from X"

- A segment of companies moving from on-prem to cloud, all suddenly searching around security and compliance

That's where data-driven personas come from: not from workshop assumptions, but from clusters of technographic and intent patterns that repeat across high-value customers.

From Static ICP to Dynamic, Data-Driven Personas

So how do you move from "generic ICP slide" to "living, data-driven persona"?

1. Start With Your Best Customers

Pull a cohort of your highest-value, happiest customers and ask:

- What firmographic traits do they share (industry, size, region)?

- Which tools or stacks do they consistently use (technographics)?

- What signals did they show before becoming customers (intent and behavior)?

You'll usually see patterns like:

- "Most of our best customers were already on HubSpot + tool X."

- "A lot of them had just raised a round or added a certain function."

- "They were consuming content on problem Y for weeks before talking to us."

Those patterns become the data spine of your persona.

2. Define Persona Layers Around Tech and Behavior

Instead of personas built only on role and industry, build them around technology context and live behavior.

Example persona structure:

- Firmographics: "Mid-market SaaS, 200–1,000 employees, North America."

- Technographics: "Using Salesforce + Marketo, adopting product analytics, patchy RevOps tooling, heavy spreadsheet usage for reporting."

- Intent & behavior: "Reading content about attribution, pipeline visibility, and integration overhead; visiting comparison pages and API docs."

Now your messaging shifts from generic "better analytics" to:

"You're already on Salesforce and Marketo, but your team is still exporting to sheets to answer basic pipeline questions. Here's how teams with your stack fix that in 30 days."

That's not just a persona. That's a playbook.

3. Let the ICP Update Itself

A real ICP is never "done." It should move as your market, competitors, and buyer behavior move.

You can:

- Continuously feed new closed-won / closed-lost data into your model to refine which tech stacks and behaviors predict success.

- Add or remove technologies from your "ideal stack" as integration partners, competitors, and adjacent tools change.

- Adjust weightings on intent signals (for example, pricing page visits might become more predictive than a generic ebook download).

Over time, you get a dynamic ICP that quietly updates in the background while your GTM team works.

How This Changes Demand Gen in Practice

Once technographics and intent are baked into your personas, your entire motion gets sharper.

- Targeting: You build audiences like "EU fintech, 50–500 employees, running Competitor A + cloud tool B, active intent around topic X."

- Messaging: You speak directly to their stack: "If you're running Competitor A plus Tool B, you already know problem Y. Here's how teams like yours fix it."

- Sequencing: High-intent, high-fit accounts get fast, direct outreach; low-intent but high-fit accounts go into education sequences.

- Account prioritization: SDRs focus on accounts with the right stack and live signals instead of just big logos in the right industry.

It becomes much harder to "spray and pray" when your targeting is anchored in how people are actually working and buying today.

A Simple Way to Start (Next 30 Days)

If you want to test this idea without rebuilding everything, try this:

- Take your current ICP and pick one segment you care about most.

- Pull technographic data for that segment—what tools they use that are relevant to your product.

- Overlay basic intent: content topics, comparison pages, event engagement, or third-party topic spikes.

- Build one new persona that explicitly includes stack + behavior.

- Run a small outbound or paid campaign just against that persona with highly specific messaging.

Then compare:

- Reply rates

- Meeting rates

- Pipeline created

against your "old" generic ICP campaigns.

Chances are, you'll see why generic ICPs are ending—and why your next best customers are hiding inside technographic + intent patterns you haven't fully tapped yet.

About us

DemandCurveMarketing (DCM) is your dedicated B2B technology growth partner. Our handpicked team of expert technology marketers empowers IT and tech-driven companies to accelerate growth through data-driven strategies and unparalleled market intelligence. We specialize in delivering hyper-targeted audience insights, advanced technographics, precise channel and industry targeting, and comprehensive data enrichment and cleansing solutions—all in one place.

With intelligence on 30,000+ vendors spanning software, hardware, cloud, networking, and emerging tech, DCM helps you deeply understand your Total Addressable Market (TAM), identify high-fit opportunities, and align your outreach and campaigns for optimal impact. Our solutions support companies of all sizes, from ambitious startups to Fortune 500 leaders, ensuring that each client has access to reliable, current, and actionable data for a competitive advantage.

Subscribe to our Technology Marketing Hacks newsletter for tailored insights and growth strategies.

Contact us for any tech or marketing queries: sales@demandcurvemarketing.com

Read our previous newsletter - The Tech-Stack Advantage: Why Understanding What Tools Your Prospects Use Is the New B2B Superpower